CFPB Extends Compliance Deadlines Under 1071 Rule

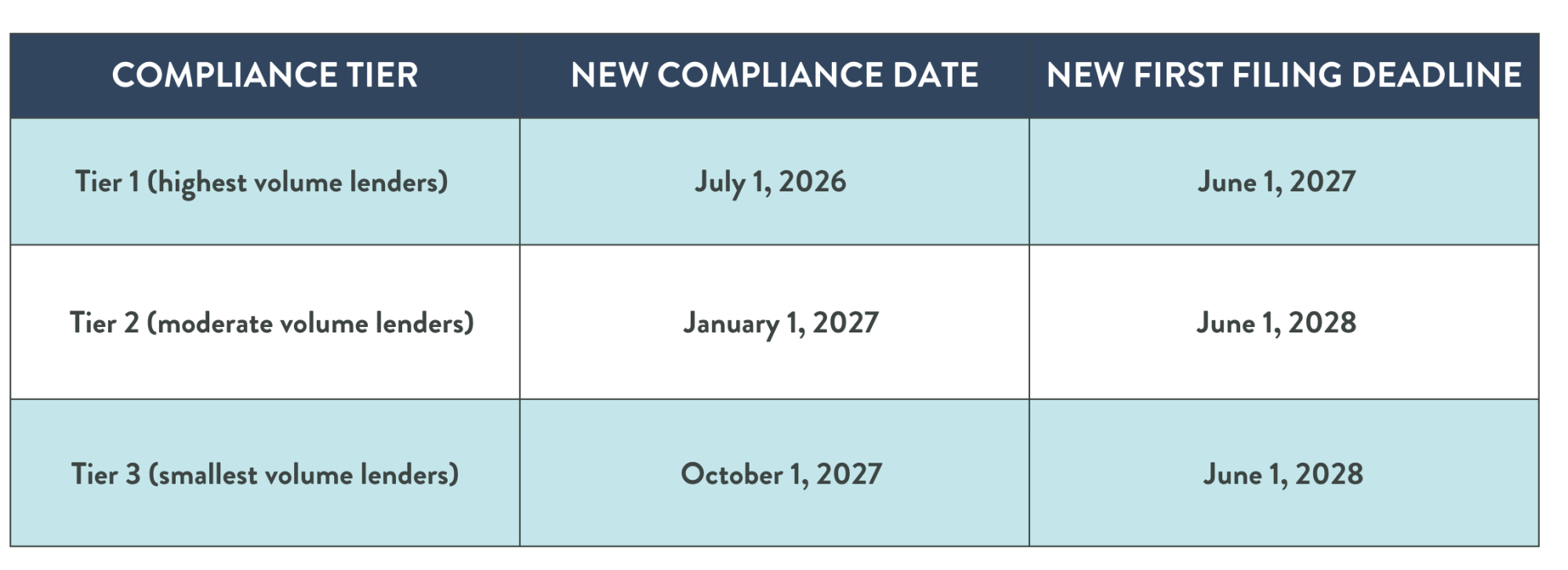

On June 18, 2025 the Consumer Financial Protection Bureau (CFPB) issued an interim final rule that amends Regulation B to extend the compliance deadline dates set forth in the small business lending data collection rule required under Section 1071 of the Dodd-Frank Act (the 1071 Rule). The new compliance deadlines are as follows:

The 1071 Rule has been subject to ongoing litigation that has impacted the compliance deadlines for certain entities. As we previously reported in February, the U.S. Court of Appeals for the Fifth Circuit stayed enforcement of the 1071 Rule and tolled its compliance deadlines, but only as applied to the plaintiffs and intervenors involved in the litigation. Further, the U.S. District Court for the Eastern District of Kentucky and the U.S. District Court for the Southern District of Florida also each issued stays for the compliance deadlines for the plaintiffs. The limited scope of these stays meant that other financial institutions remained subject to the rule and the existing compliance schedule until the CFPB clarified its position.

Subsequently, as we previously reported in May, the CFPB clarified its position by announcing that it will not prioritize enforcement or supervision actions under the 1071 Rule.

Now, this interim final rule will formally extend the compliance dates for all covered financial institutions that are not subject to the stays imposed by the courts.

Additional Changes Under the Interim Final Rule

In addition to extending the compliance dates, the interim final rule also updated the grace period policy statement for data collected in 2026 and 2027 and a portion of data collected in 2028 to correspond to the updates to the compliance deadlines.

The interim final rule did not make any changes to the section that permits covered financial institutions to voluntarily collect data 12 months prior to such entity’s compliance date.

Comments on Interim Final Rule

The CFPB is seeking comments on the interim final rule. All comments are due on or before July 18, 2025.

Pending Legislation and New Notice of Proposed Rulemaking

We note that there are two bills pending with Congress related to the 1071 Rule. First, Senate Bill 557, “1071 Repeal to Protect Small Business Lending Act,” proposes repealing Section 1071 of the Dodd-Frank Act, which provides the statutory support for the 1071 Rule.

Second, House Bill 941, “Small Lenders Exempt from New Data and Excessive Reporting Act” or the “Small LENDER Act,” proposes amending the 1071 Rule, in part, to (1) provide financial institutions with a three year period to comply with the 1071 Rule, and (2) exempt small businesses with gross annual revenues of $1 million or less from the 1071 Rule.

Additionally, the CFPB previously stated that it anticipates issuing a new Notice of Proposed Rulemaking (NPRM) under the 1071 Rule. The CFPB reiterated in the interim final rule that it plans on issuing this NPRM “as expeditiously as reasonably possible.”

We are closely tracking these developments and will continue to provide updates as the situation evolves.