The Evaluator: Deadlines Looming in 15 States

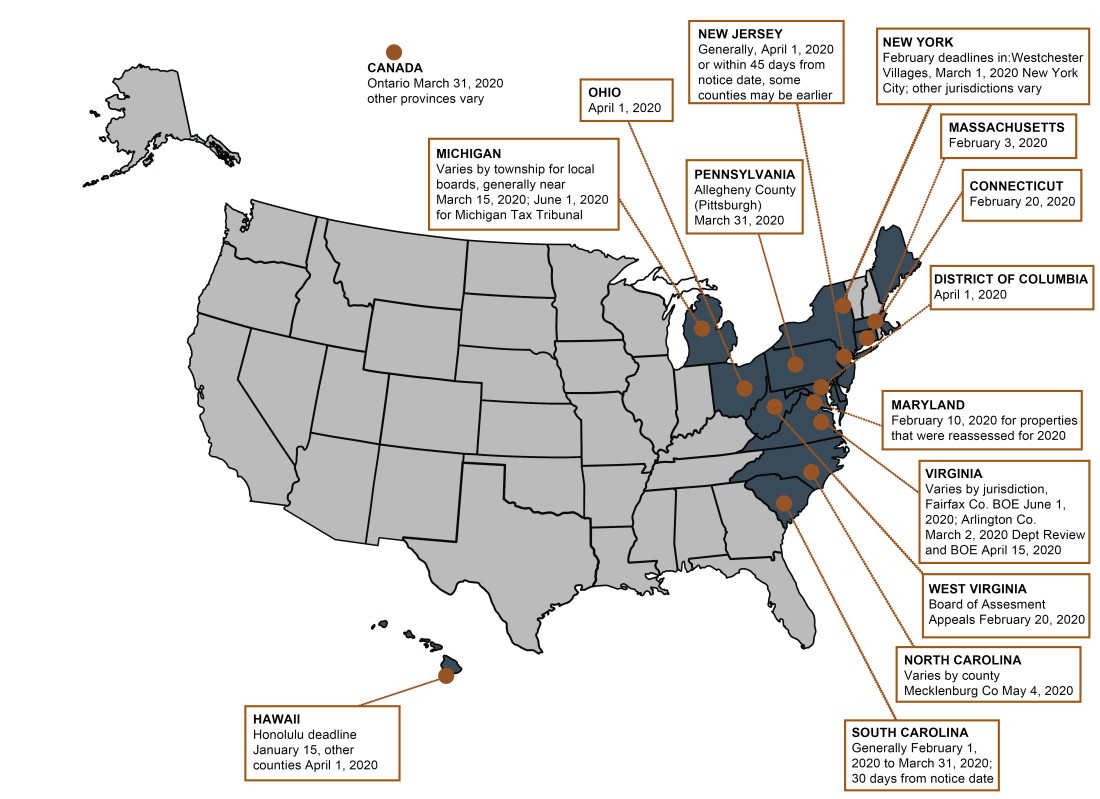

Taxpayers seeking to contest real property tax values established by assessing jurisdictions across the country often have a short window of opportunity to contest their new valuation. This time frame varies by state and by local jurisdiction, and in many cases begins to run upon the mailing of a new value notice. Below is a map of states/jurisdictions with upcoming appeal deadlines:

Property taxes are frequently the largest non-productive expense incurred by property owners, and proactive management of this expense may result in increased profitability. Now is the time to review your tax assessments to make sure that each property is valued appropriately and that you are paying your fair share, and only your fair share, of the property tax burden.

Vorys has significant experience in analyzing real property tax values and securing real property tax savings for taxpayers across the country. To discuss an analysis of the opinions of value assigned by your local assessing jurisdiction, please contact us to discuss further.

*The map is for informational purposes only and does not constitute legal advice. In some cases appeal dates vary by jurisdiction and notice date. To discuss the appeal deadline for a specific property contact Vorys.