Securities and Exchange Commission Finalizes Climate Disclosure Rules

The Securities and Exchange Commission (SEC) has released a significantly narrowed final version of its climate disclosure rule. The approval is described in the SEC's Fact Sheet, The Enhancement and Standardization of Climate-Related Disclosures: Final Rule, released in advance of the SEC's March 6, 2024, approval.

Originally proposed May 2022, the climate disclosure rule was intended to require public companies to release a range of climate-related data and risks. Most significantly, the original proposed rule required disclosure of three categories of greenhouse gas emissions: scope 1, defined as direct emissions; scope 2, defined as emissions from purchased and consumed energy; and scope 3, defined as emissions from a company’s value chain — if those emissions were “material.”1

As previewed by the SEC chairman in recent statements, the final rule scales back the disclosure requirements and the companies subject to the climate-related disclosure provisions of the rule. Crucially, the final rule removes entirely the requirement to disclose scope 3 greenhouse gas emissions. The final rule also removes the proposed requirement to describe board members' climate expertise; however, the final rule moved forward with requiring large accelerated filers and accelerated filers to disclose scope 1 and 2 greenhouse gas emissions that are “material."

The final rule continues to require reporting of other climate-related information, including material climate-related risks, the process for identifying, assessing, and managing the risks, mitigation or adaptive activities, any material climate-related targets or goals, and board oversight of climate risks. Importantly, the final rule retains a limited version of the requirement to disclose costs associated with severe weather and sea-level rise. Instead of having to disclose the effect on each line item, the final rule requires a general disclosure of the capitalized costs, expenditures, charges and losses from severe weather and sea-level rise.

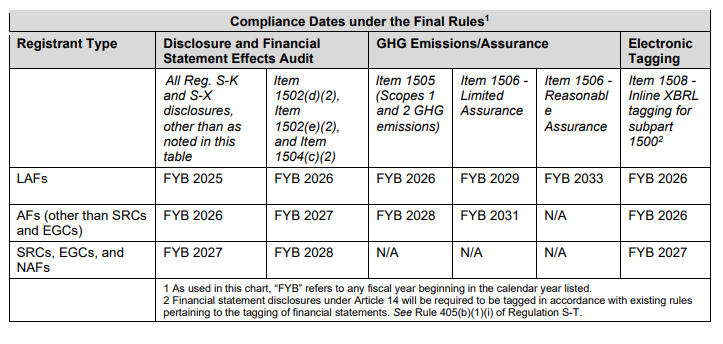

The rule will be effective 60 days after it is published in the Federal Register, and is expected to prompt significant litigation. As shown below, compliance deadlines are phased in, beginning in the fiscal year beginning in 2025.

1. Typically, information is material when there is “substantial likelihood that a reasonable investor would consider the information important in deciding how to vote or make an investment decision.” Basic Inc. v. Levinson, 485 U.S. 224, 231, 232, and 240 (1988).

UPDATE:

As predicted, the SEC Climate Disclosure Rules were promptly challenged, with nine cases being filed in six appellate courts across the country. On March 15, the Fifth Circuit issued a temporary stay of the Rule. The SEC requested consolidation and, after a lottery, on March 21 the U.S. Judicial Panel on Multidistrict Litigation issued an order randomly assigning the case to the Eighth Circuit Court of Appeals. The Iowa Attorney General's Office is leading the case initially filed in the Eighth Circuit, which includes eight other states (Arkansas, Idaho, Missouri, Montana, Nebraska, North Dakota, South Dakota and Utah). Stinson environmental, securities, and appellate lawyers routinely handle matters in and in cases front of the Eighth Circuit and are happy to discuss their experience.

For more information on the climate disclosure rule, please contact Brittany Barrientos, Kristen Ellis Johnson, Dennis Lane, Jeremy Root, Sarah Lintecum Struby, J. Nicci Warr, Claire Williams or of the attorneys listed below or the Stinson LLP contact with whom you regularly work.