Health Insurance in 2014 - Employer Pay-or-Play Penalties

Published in the Spring 2013 issue of The Bankers' Statement

If your bank offers group health coverage to employees, you know that the Affordable Care Act (commonly known as "Obamacare") has impacted the design of your group health plan. For example, coverage is now available to employees' adult children (up to age 26), lifetime limits on benefits are being phased out, and preventive services are covered with no employee cost-sharing. This article is intended to help you understand that the next phase of health care reform has implications beyond group health plan design; the tax penalties going into effect in 2014 may be a factor in decisions you make about your workforce.

If your bank is an applicable large employer, it will be subject to two types of non-deductible tax penalties (known as pay-or-play penalties) starting in 2014:

- No-offer penalty – Imposed on an applicable large employer member when it fails to offer health coverage to substantially all of its full-time employees (and their children) and one or more of its full-time employees buys health insurance on an exchange with premium assistance.

On an annual basis, the no-offer penalty equals $2,000 times [the number of full-time employees employed by the member minus the member's ratable share of 30].

- Unaffordable/inadequate coverage penalty – Imposed when an applicable large employer member offers medical coverage that is unaffordable or inadequate and one or more of its full-time employees buys health insurance on an exchange with premium assistance.

On an annual basis, the unaffordable/inadequate coverage penalty equals $3,000 times the number of the member's full-time employees who are getting premium assistance.

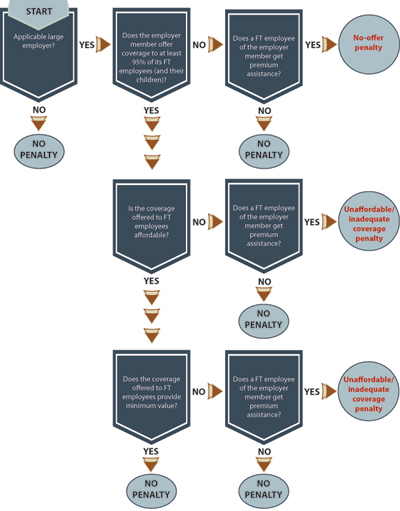

Determining whether your bank is subject to penalties, when your bank has incurred a penalty, and the amount of the penalty is a multi-step process. The IRS has proposed rules governing these determinations. See flowchart below (click to enlarge).

Although some changes to the rules can be expected, the time is now to work out a strategy for avoiding or minimizing the penalties.

What is an "applicable large employer"?

The pay-or-play penalties apply to "applicable large employers." An "applicable large employer" is an employer with at least 50 full-time and full-time equivalent employees in the preceding calendar year. (For purposes of determining applicable large employer status in 2014, you have the option to count employees in a six-month period, rather than the entire year of 2013.)

In determining "applicable large employer" status, you must aggregate employees of entities in: (a) a controlled group of corporations; (b) trades or businesses under common control; and (c) an affiliated service group. If you have a question as to whether your bank is an applicable large employer (i.e., will be subject to the pay-or-play penalties in 2014), please let us know. If you are an applicable large employer and you don't have a compliance strategy, you could inadvertently trigger costly penalties.

Although you have to aggregate affiliated entities for purposes of determining whether your bank is part of an applicable large employer, penalties are calculated separately for each entity (called an "applicable large employer member"). Note that flow-through entities (like limited liability corporations) count as separate entities for purposes of this rule.

Substantial compliance is good enough

An applicable large employer member can avoid the no-offer penalty by offering coverage to 95% of its full-time employees (and the employees' children). The failure to offer coverage to the other 5% of the member's full-time employees will not trigger a no-offer penalty – regardless of whether the failure is inadvertent or by design.

For an applicable large employer member with fewer than 100 full-time employees, the substantial compliance standard is even more favorable. The applicable large employer member can avoid the no-offer penalty by offering coverage to all but five of its full-time employees, even though the resulting offer of coverage would be to less than 95% of the member's full-time employees.

Identification of full-time employees

One of the significant tasks imposed on applicable large employers is the identification of full-time employees in accordance with detailed IRS guidelines. IRS guidelines provide for three consecutive periods:

- Measurement period – The employer must pick a measurement period of between three and 12 months. The hours of part-time, variable-hour, and seasonal employees will need to be cumulated during the measurement period. For this purpose, an employee is credited with all hours for which he or she is entitled to payment (including vacation and sick time). If an employee works an average of at least 30 hours per week (130 hours per month) during the measurement period, he or she must be classified as full-time.

- Administrative period – The administrative period follows the measurement period. During the administrative period, the employer tallies hours during the measurement period and provides enrollment materials to any employees determined to be full-time.

- Stability period – The stability period follows the administrative period. Any employee who was determined to be full-time based on hours during the measurement period must be treated as full-time during the stability period. The stability period for employees determined to be full-time must be at least six months and no shorter than the measurement period.

Since hours in 2013 will determine full-time or part-time status in 2014, you will want to model options for your workforce. Please let us know if you want additional details or assistance in this regard.

You'll have to offer health coverage to children – but not spouses

An applicable large employer member will need to offer health coverage to the children of full-time employees – but not the spouses of full-time employees – in order to avoid the no-offer penalty.

Affordable, adequate health coverage

If your health coverage is not affordable and/or adequate and one or more employees qualifies for premium assistance to buy individual health insurance on an Exchange, you will incur an unaffordable/inadequate coverage penalty.

To determine "affordability," you divide a numerator by a denominator, as described below. A result that does not exceed 9.5% is deemed to be affordable for purposes of the unaffordable/inadequate coverage penalty.

- The numerator of the affordability fraction is the employee contribution for single coverage. If you have more than one option for medical coverage, you may use the least expensive option providing adequate coverage (i.e., 60% minimum value). The IRS has not yet addressed how smokers' and wellness premium differentials are treated.

- The denominator of the affordability fraction is supposed to be employee's household income. Of course, you (as an employer) won't know your employees' household income. To simplify the determination of affordability, the IRS offers three safe harbor options:

— Form W-2 safe harbor – Form W-2 Box 1 income for the months during which the employee was eligible for coverage.

— Rate of pay safe harbor – A salaried employee's monthly salary or an hourly employee's rate of pay multiplied by 130 hours for the months during which the employee was eligible for coverage.

— Federal poverty line (FPL) safe harbor – The federal poverty line for a single individual. For 2013, the federal poverty line for a single individual was $11,490.

Health coverage is adequate (i.e., provides minimum value) if it would cover 60% of the benefit costs incurred by a standard population. The government is expected to provide design checklists for determining minimum value. If your health plan has a non-standard design, minimum value may be demonstrated through an online calculator or actuarial certification.