Labor and Employment Alert: $2,500 Limit On Health FSAs, More Guidance on SBCs, and Other Employee Benefits News

The future of the Patient Protection and Affordable Care Act (ACA) will be determined by the Supreme Court decision expected this month. In the meantime, the regulatory agencies have continued to develop guidance that will apply to employers' group health plans – assuming health care reform survives intact.

$2,500 limit on health flexible spending arrangement (FSAs)

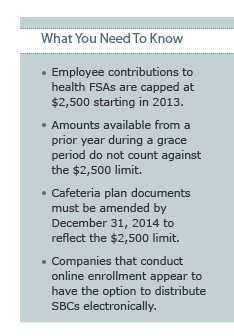

If your company offers health flexible spending arrangements (FSAs), your 2013 open enrollment materials should note the new $2,500 cap on employee contributions. The ACA places a $2,500 limit (indexed for inflation) on employee contributions to a health FSA starting in 2013. IRS Notice 2012‑40 (released May 30, 2012) provides the following details:

- If your company's health FSAs operate on a 12-month period other than the calendar year, you are in luck. The $2,500 limit does not apply until the first plan year starting on or after January 1, 2013.

- The $2,500 annual limit only applies to employees' pre-tax contributions. If your company makes employer (non-elective) contributions to health FSAs or provides non-cashable flex credits that may be allocated to health FSAs, those employer contributions or flex credits do not count against the $2,500 limit.

- If your company's health FSAs have a grace period, the amount carried over from Year 1 and made available during the grace period (the first 2 ½ months of Year 2) does not count against the $2,500 limit for Year 2.

- In the event of error due to a reasonable mistake (and not willful neglect) that results in an employee contribution to a health FSA in excess of $2,500, the excess may be paid to the employee and reported as wages for the year in which the excess is paid to the employee.

- The $2,500 limit is applied on a controlled group basis. If an employee works for two or more members of a controlled group, the employee's limit for all health FSAs sponsored by members of the group is $2,500.

- The limit applies separately to each employee so that a husband and wife can each contribute up to $2,500 (even if employed by the same employer) to a health FSA.

Your company should have a cafeteria plan document spelling out the operation of the FSAs. Typically, you must amend your cafeteria plan document before implementing a change to your FSA program. However, the IRS will allow until December 31, 2014 for a company to amend its cafeteria plan document to reflect the $2,500 limit on employee contributions to a health FSA. Note that, even if you chose to delay your cafeteria plan document amendment, you must apply the $2,500 limit in operation.

Intriguingly, the IRS solicited comments on its use-or-lose rule. The use-or-lose rule requires that any credit balance in a health FSA at the end of a year (or, for plans with a grace period, at the end of the grace period) be forfeited. In connection with the $2,500 limit, the IRS is considering whether the use-or-lose rule should be modified. The deadline for comments is August 17, 2012.

Yet more guidance on summaries of benefits and coverage (SBCs)

Our April 18, 2012 Client Alert summarized DOL FAQs Part VIII on the summaries of benefits and coverage (SBCs). Now we have DOL FAQs Part IX and new items posted on the Center for Consumer Information & Insurance Oversight (CCIIO) website, that provide additional guidance on SBCs:

- If you conduct open enrollment online (that is, employees are expected to enroll and make changes online during open enrollment), DOL FAQ-1 seems to allow you to provide the SBC online (in lieu of paper) as long as individuals can receive a paper copy upon request.

Q1: A previous FAQ outlined the circumstances in which an SBC may be provided electronically. The FAQ discussed a safe harbor for providing the SBC to participants or beneficiaries covered under the plan who are able to effectively access documents provided in electronic form at the worksite. Are there any additional safe harbors for electronic delivery of SBCs?

Yes. The Departments have adopted the following additional safe harbor. SBCs may be provided electronically to participants and beneficiaries in connection with their online enrollment or online renewal of coverage under the plan. SBCs also may be provided electronically to participants and beneficiaries who request an SBC online. In either case, the individual must have the option to receive a paper copy upon request. (In addition, for individual market issuers that offer online enrollment or renewal, the SBC may be provided electronically, at all issuances, to consumers who enroll or renew online, consistent with the regulations.)

- Expatriate plans get a one-year reprieve. Recognizing the unique circumstances of expatriate plans, the government stated it will not enforce the SBC requirement with respect to expatriate plans during the first year the rules would otherwise apply (2013 for calendar year plans).

- CCIIO posted a corrected version of the SBC template on May 11, 2012. Although the corrections were minor, you will want to be sure you have the right template when you start working on your SBC.

- The CCIIO website includes a new calculator that you can use as a safe harbor in preparing the SBC coverage examples for 2013. A different methodology will probably be required for 2014.

- Spanish, Chinese, and Tagalog versions of the SBC template are not yet posted to the CCIIO website but are available upon request to sbc@cms.hhs.gov.

Other Employee Benefits News

Crawling toward a usable definition of essential health benefits

Starting in 2014, insurance sold on state insurance exchanges will need to include all so-called essential health benefits. Self-insured group health plans (and large insured group health plans) need not include all essential health benefits. However, any essential health benefit that is included in a group health plan cannot be subject to an annual or lifetime dollar limit.

Defining essential health benefits posed a difficult political problem for HHS in that every potential non-essential health benefit has a constituency and advocacy group. In a Bulletin dated December 16, 2011, HHS cleverly ducked the problem by proposing that each state select a benchmark plan from among options specified by HHS. The benefits in the state's selected benchmark plan would (with some modifications) be the essential health benefits for that state in 2014 and 2015. An FAQ included in a February 17, 2012 HHS Bulletin seems to allow a self-insured group health plan to select a single benchmark plan from among the options available to the states. On June 1, 2012, HHS published proposed regulations that will require states and insurers to submit detailed information on benefits included in potential benchmark plans. Such information, when available, should help the sponsor of a self-insured group health plan to make an informed selection of a benchmark plan for purposes of identifying essential health benefits.

Assessments in 2014, 2015 and 2016 to fund reinsurance program

The state insurance exchanges will have three programs intended to allocate risk among participating insurers: the risk adjustment program, the risk corridor program and the reinsurance program. The programs are the subject of regulations and other guidance. The latest was a Bulletin published May 31, 2012.

The risk adjustment program is intended to be permanent. The risk corridor and reinsurance programs are only in effect in 2014, 2015 and 2016. While the risk adjustment and risk corridor programs are funded solely by insurers, the reinsurance program is funded by contributions from both insurers and third-party administrators (TPAs) administering self-insured group health plans. Expect TPAs to pass these assessments on to employers.

The amount of the contributions for the reinsurance program will be based on a national per capita rate, expected to be announced in October 2012 (for 2014, 2015 and 2016). The assessment will not apply to plans that provide only excepted benefits.

________________

IRS CIRCULAR 230 DISCLOSURE: In order to ensure compliance with requirements imposed by the U.S. Internal Revenue Service, we inform you that any federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and it cannot be used, by any taxpayer for the purpose of (i) avoiding penalties that may be imposed under the U.S. Internal Revenue Code or (ii) promoting, marketing, or recommending to another person, any transaction or other matter addressed herein.

This client alert is for general information purposes and should not be regarded as legal advice.