SEC Adopts New Climate-Related Disclosure Rules

On March 6, 2024, the U.S. Securities and Exchange Commission (SEC) adopted a final rule that will require public companies to provide certain climate-related information in their registration statements and annual reports. The final rule imposes the disclosure of climate-related risks under new subpart 1500 of Regulation S-K and the disclosure of the certain financial statement impacts of climate-related matters under new Article 14 of Regulation S-X.

Overview

Under Regulation S-K, companies will be required to disclose:

- any material climate-related risks;

- the governance and management of the company’s material climate-related risks;

- any climate-related targets or goals that have materially affected or are reasonably likely to materially affect the company’s business, results of operations, or financial condition; and

- any material Scope 1 and Scope 2 emissions if the company is a large, accelerated filer (LAF) or an accelerated filer (AF) that is not otherwise exempt, along with an attestation report.

Under Regulation S-X, companies will be required to disclose:

- the financial statement effects of severe weather events and other natural conditions;

- the financial statement effects related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of the company’s plans to achieve its disclosed climate-related targets or goals; and

- if the estimates and assumptions the company uses to produce its financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted.

Importantly, the final rule provides a number of materiality qualifiers. The SEC has confirmed that assessments of materiality under the final rule refers to the importance of information to investment and voting decisions about a particular company, not to the importance of the information to climate-related issues outside of those decisions.

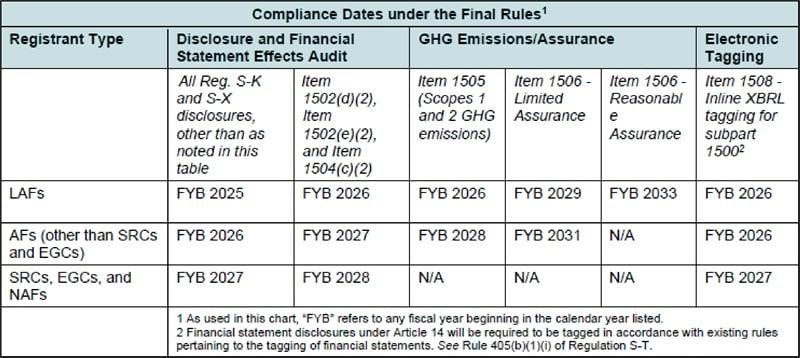

The new requirements are subject to various phased-in compliance dates. The new narrative and quantitative climate-related disclosures must be electronically tagged in Inline XBRL.

New Requirements

Description of Material Climate-Related Risks

Companies will be required to disclose (1) any actual or potential negative impacts of climate-related risks that have materially impacted or are reasonably likely to have a material impact on the company, including on its strategy, results of operation, or financial condition, (2) the actual or potential material impact of those same risks on its strategy, business model, and outlook, (3) the company’s activities to mitigate or adapt to a material climate-related risk or assess the impact of climate-related risks including the use, if any, of transition plans, scenario analysis, or internal carbon prices, and (4) the material expenditures incurred and material impact on financial estimates and assumptions that directly result from mitigation or adaptation activities.

Governance and Risk Management

Companies will be required to disclose (1) the board of directors’ oversight of climate-related risks, (2) management’s role in assessing and managing material climate-related risks, (3) the processes the company has in place for identifying, assessing, and managing material climate-related risks, and (4) if the company is managing material climate-related risk, whether and how any such processes are integrated into the company’s overall risk management system or processes.

Effect of Climate-Related Targets and Goals

The final rules require companies to disclose any climate-related target or goal that has materially affected or is reasonably likely to materially affect its business, results of operations, or financial condition. Such disclosure must include any additional information or explanation necessary to an understanding of the material impact or reasonably likely material impact of the target or goal, including, as applicable, a description of the scope of activities included in the target, the unit of measurement, the defined time horizon by which the target is intended to be achieved, and whether the time horizon is based on one or more goals established by a climate-related treaty, law, regulation, policy, or organization, any established baseline time period and the means by which progress will be tracked, and a qualitative description of how the company intends to meet the targets or goals. Companies are also required to annually disclose any progress made toward meeting their climate-related targets or goals.

Scope 1 and Scope 2 Emissions

If a company is a LAF or an AF that is not otherwise exempted, and its Scope 1 emissions (direct greenhouse gas (GHG) emissions from operations that are owned or controlled by a company) and/or its Scope 2 emissions (indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat, or cooling that is consumed by operations owned or controlled by a company) metrics are material, the company will be required to (1) disclose its Scope 1 and/or Scope 2 emissions and (2) describe the methodology, significant inputs, and significant assumptions used to calculate the company’s disclosed GHG emission. In addition to the inclusion of the GHG emission information in registration statements, required companies must include the GHG emission information annually in Form 10-K, in the Form 10-Q for the second quarter in the fiscal year immediately following the year to which the GHG emissions disclosure relates, or in an amendment to the Form 10-K filed no later than the due date for the second quarter Form 10-Q. If required to disclose Scope 1 and Scope 2 emissions, the company must provide such disclosure for its most recently completed fiscal year and, to the extent previously disclosed, for the historical fiscal year(s) included in the applicable filing.

In addition, a company that is required to disclose Scope 1 and/or Scope 2 emissions must file as part of the applicable filing an attestation report in respect of those emissions subject to phased in compliance dates. An AF must file an attestation report at the limited assurance level beginning the third fiscal year after the compliance date for disclosure of GHG emissions. A LAF must file an attestation report at the limited assurance level beginning the third fiscal year after the compliance date for disclosure of GHG emissions, and then file an attestation report at the reasonable assurance level beginning the seventh fiscal year after the compliance date for disclosure of GHG emissions. The final rules also require a company that is not required to disclose its GHG emissions or to include a GHG emissions attestation report to disclose certain information if the company voluntarily discloses its GHG emissions in a filing and voluntarily subjects those disclosures to third-party assurance.

Financial Impact of Severe Weather Events and Other Natural Conditions

Pursuant to new Article 14 of Regulation S-X, companies will be required to disclose the capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions (such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise), subject to applicable one percent and de minimis disclosure thresholds. The financial statement disclosures under Regulation S-X will be required for the company’s most recently completed fiscal year, and to the extent previously disclosed or required to be disclosed, for the historical fiscal years included in the filing, in a note to the company’s audited financial statements.

The one percent threshold provides that (1) the aggregate amount of expenditures expensed as incurred and losses equals or exceeds one percent of the absolute value of income or loss before income tax expense or benefit for the relevant fiscal year (subject to a minimum of $100,000 of expenditures expensed and losses as incurred) and (2) the aggregate amount of the absolute value of capitalized costs and charges recognized equals or exceeds one percent of the absolute value of stockholders’ equity or deficit, at the end of the relevant fiscal year (subject to a minimum of $500,000 of capitalized costs and charges).

Financial Impact Related to Carbon Offsets and RECs

If carbon offsets or RECs have been used as a material component of a company’s plan to achieve its disclosed climate-related targets or goals, it will be required to disclose the aggregate amounts of (1) carbon offsets and RECs expensed, (2) carbon offsets and RECs capitalized, and (3) losses incurred on the capitalized carbon offsets and RECs during the fiscal year. Companies will also be required to disclose where on the income statement or balance sheet the capitalized costs, expenditures expensed, and losses related to carbon offsets and RECs are presented under the final rules. This disclosure requirement is not subject to the one percent disclosure threshold that applies to the disclosure of severe weather events and other natural conditions.

Impact on Development of Financial Statement Estimates and Assumptions

Companies must disclose whether the estimates and assumptions it used to produce its financial statements were materially impacted by exposures to risks and uncertainties associated with, or known impacts from, severe weather events and other natural conditions or any disclosed climate-related targets or transition plans. If so, the company must provide a qualitative description of how the development of such estimates and assumptions were impacted by such events, conditions, targets, or transition plans.

Compliance Dates

The final rules will be phased in, with the applicable compliance dates dependent upon the status of a company as an LAF, an AF, a nonaccelerated filer (NAF), a smaller reporting company (SRC), or an emerging growth company (EGC), and the content of the disclosure. Please see the following table for details.

Source: https://www.sec.gov/files/33-11275-fact-sheet.pdf

Please contact your Vorys attorney with any questions about these rules.