Consumer Law Hinsights – July 2020

Welcome to Consumer Law Hinsights―a monthly compilation of nationwide consumer protection cases of interest to financial services and accounts receivable management companies. This edition highlights our interactive COVID-19 regulatory map, two recent federal appellate rulings, and a selection of recent posts from our blog, Consumer Crossroads.

>>Download a printable version of the newsletter

You can also expand each of the topics below to read our full analysis of the cases and blog posts covered in this edition.

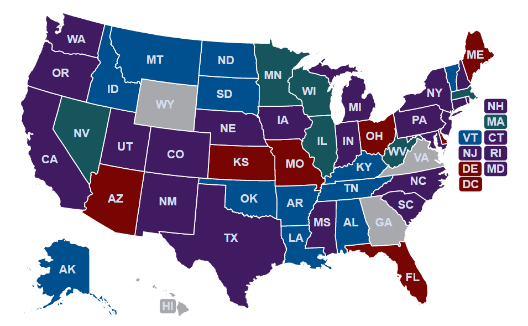

Tracking State Regulators' Response to COVID-19

To assist consumer financial services lenders, servicers, and investors, Hinshaw created an interactive tracker of state regulations related to the COVID-19 pandemic. The tracker documents actions by various state regulators, along with the limits imposed by states on foreclosures, evictions, and debt collections, and allows users to click on any state to view applicable provisions.  |

Eleventh Circuit Addresses Willfulness Standard under FCRA

A consumer, Shaun Younger, resolved a small-claims debt on January 12, 2015, but as of March 30, 2015, the debt still appeared on his credit report. He sent a letter to Experian asking the company to investigate and remove the debt. On receipt of the letter, an Experian employee determined it should be diverted according to Experian's "suspicious mail policy." Experian then sent a letter on April 15, 2015, notifying him that the letter had been diverted and provided him with a phone number to call in case Younger felt there was a mistake on his credit report. Experian did not reinvestigate the matter. Shortly thereafter, the holder of the debt notified Experian that it should be removed, and Experian removed it from the consumer's file. The consumer did not call Experian as instructed by the April 15, 2015 letter, and instead sued for violations of the Fair Credit Reporting Act (FCRA).

The consumer argued that Experian was under a duty to reinvestigate his claim when they received his letter. Experian argued that they were under an additional requirement to protect the personal information of consumers from unauthorized parties. As part of their effort to do so, Experian implemented their "suspicious mail policy." At trial, Experian conceded that it misclassified Younger's letter, and explained that an investigation would require a notification to the consumer, which could result in personal information ending up in the wrong hands unless Experian could successfully verify the consumer. At trial, Experian was found to have willfully violated the FCRA, and the verdict included a $3 million punitive damage award, which was reduced to $490,000 by the trial judge after post-trial motions.

The Eleventh Circuit rejected the finding of willfulness and the punitive damage award, and clarified the standard for willful conduct. While Experian behaved negligently in regard to Younger, there was no evidence of a broad or systemic problem with Experian's suspicious mail policy—even if they could have been more diligent in their review process. Ultimately, a finding of willfulness required clear and convincing evidence that Experian ran an unjustifiably high risk of violating its duties under the FCRA.

The case is Younger v. Experian Information Solutions Inc. LLC., No. 19-11487 (11th Cir. 2020).

Seventh Circuit Reiterates that Qualified Language Needs Extrinsic Evidence to Support Claims

A debt collector sent a consumer a letter stating that it "may" inform the national credit bureaus of her delinquency, and that the debt would be extinguished if she paid a specified amount by a certain date. The consumer claimed that the word "may" meant that any possible reporting to the national credit bureaus would happen in the future, and that if she paid the specified amount by the deadline, the debt collector would not report her to the national credit bureaus. Instead, the debt collector reported the delinquency to the national credit bureaus prior to the deadline, and the consumer claimed the letter therefore violated the Fair Debt Collection Practices Act (FDCPA).

The Seventh Circuit reiterated that in its jurisdiction, there are three categories of misleading statements: (1) those that are obviously not misleading; (2) those that are not misleading on their face, but that could mislead an unsophisticated consumer; and (3) those that are so plainly false so as to require no additional evidence from the consumer. The court found that this consumer's claim fell into the second category, which put the burden on the consumer to produce evidence of confusion. This evidence—usually in the form of a consumer survey—needed to show that a substantial number of recipients would face the same confusion that the consumer claims. The Seventh Circuit rejected the consumer's argument that because the language was susceptible to more than one interpretation she had met her evidentiary burden to prove confusion. The court explained that any confusion is not sufficient, instead the consumer had to show that a "significant fraction" of the population would have reached the same conclusion as she did.

The case is Johnson v. Enhanced Recovery Co., LLC, No. 19-1210 (7th Cir. 2020).

Consumer Crossroads Blog | Quarterly Highlights

SCOTUS Holds CFPB's Single Director Structure Unconstitutional, Leaves Open Questions on Existing Bureau Matters

The U.S. Supreme Court issued a two part decision in Seila Law LLC v. Consumer Financial Protection Bureau. The Court first decided, in a 5-4 decision with Chief Justice Roberts authoring the Court's opinion, that the CFPB's leadership by a single Director removable only for inefficiency, neglect, or malfeasance violates the separation of powers doctrine. The Court next decided that the Director's unconstitutional removal protection is severable from the other provisions of Dodd-Frank that establish the CFPB and define its authority… >>Read more

New York State Enacts New Procedures for Residential Mortgage Forbearance Plans

On June 17, 2020, New York Governor Andrew Cuomo signed Senate Bills 8243C and 8428 into law, adding Section 9-x to the Banking Law. The section creates new procedures for mortgagors and servicers in relation to forbearances of residential mortgage payments affected by the COVID-19 pandemic… >>Read more

FCC Clarifies Autodialer Definition, Including in Bulk Text Message Context

The Federal Communications Commission (FCC) recently issued a Declaratory Ruling clarifying the definition of an autodialer. Exactly what constitutes an autodialer under the TCPA has been a burgeoning topic in consumer litigation. The TCPA prohibits any person from texting or calling a cellular telephone number using an automatic dialing system without prior express consent… >>Read more