Labor and Employment Alert: Health Plans Must Pay Reinsurance Fees and Other Employee Benefits News

The regulatory agencies (the IRS, DOL, and HHS) have started to fill in some (but by no means all) of the gaps in the Affordable Care Act guidance needed to implement the transformation of health coverage that is supposed to happen in 2014. Here is a rundown of new guidance relevant to employers that sponsor group health plans for their employees.

The regulatory agencies (the IRS, DOL, and HHS) have started to fill in some (but by no means all) of the gaps in the Affordable Care Act guidance needed to implement the transformation of health coverage that is supposed to happen in 2014. Here is a rundown of new guidance relevant to employers that sponsor group health plans for their employees.

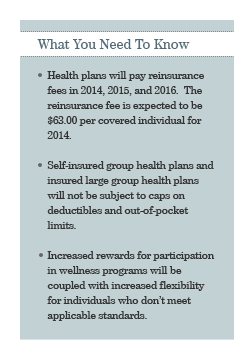

Reinsurance fee for 2014 expected to be $63 per covered individual

Reinsurance fees will be imposed on both self-insured and insured group health plans in 2014, 2015, and 2016. HHS announced in proposed regulations that the reinsurance fees will be $63 ($5.25 per month) per covered individual in 2014. (The reinsurance fees are expected to be about 33% less in 2015 and 60% less in 2016 but the actual amounts for those years won't be known until announced by HHS. HHS may choose to defer part of the 2014 fee until 2015 or 2016 when the rates are lower. No reinsurance fees are imposed in years after 2016.) The reinsurance fees will be distributed to insurers selling coverage on the Exchanges to offset the cost of covering individuals with high claims. Since insurers will be responsible for collecting and paying the reinsurance fees on insured plans, the focus of this Vorys Client Alert is the application of the reinsurance fees to self-insured plans.

The reinsurance fee is imposed on medical plans (irrespective of grandfathered status). The reinsurance fee does not apply to excepted benefits (such as most dental plans, vision plans, and health flexible spending accounts). It does apply to health reimbursement arrangements (HRAs) but, if an individual is covered by both a medical plan and an HRA, you only have to count the individual once; the medical plan and HRA are treated as a single plan. The reinsurance fee also applies to retiree health plans but retirees and dependents for whom Medicare is the primary payer are not included in the count of covered individuals.

The reinsurance fees are separate from and in addition to the Patient Centered Outcomes Research (PCOR) fees. See our April 18, 2012 Vorys Client Alert for details of the PCOR fee. However, the methods for counting covered individuals (i.e., covered employees, spouses, partners, and children) for the two fees are similar:

- Actual count method: Count the actual number of covered individuals on each day of the first nine months of the calendar year and divide by the number of days.

- Snapshot count method: Count the actual number of covered individuals on at least one day in each of the first three quarters of the calendar year and divide by the number of sample days.

- Snapshot factor method: On at least one day in each of the first three quarters of the calendar year, count:

(a) the actual number of employees enrolled in single coverage; and

(b) the actual number of employees enrolled in coverage that includes at least one family member (e.g., employee plus spouse, employee plus one or more children, and family coverage) and multiply that number by 2.35.

Divide the total by the number of sample days.

- Form 5500 method: If the plan offers family coverage, add the number of participants reported at the beginning of the most recent Form 5500. Since the participant counts on Form 5500 do not include family members, this doubling of the number of reported participants is intended to reflect the fact that some reported participants have coverage for family members. However, if the plan does not offer family coverage, the total may be divided by two to reflect the average number of participants during the plan year.

You do not have to use the same counting method for the reinsurance fees and the PCOR fees and, even if you do, you will probably not have the same head count because: (a) the count for the PCOR fee is based on your plan year; and (b) the count for the reinsurance fee is based on the first nine months of the calendar year.

Your third party administrator is supposed to report the number of covered individuals by November 15, 2014. HHS will generate a bill within 15 days. The plan sponsor is then responsible for paying the reinsurance fee within 30 days of the HHS bill.

Self-insured group health plans not subject to 2014 caps on deductibles and out-of-pocket limits

It now appears that self-insured group health plans (and insured large group health plans) will not be subject to the deductible and out-of-pocket limit caps applicable to individual health insurance policies and insured small group health plans. For plan or policy years beginning in 2014, individual health insurance policies and insured small group health plans sold on the exchanges will not be permitted to have:

- a deductible that exceeds $2,000 for single coverage or $4,000 for family coverage, indexed (although some increase may be permitted for the lowest-value insurance policies); or

- an out-of-pocket limit that exceeds the maximum level compatible with health savings account (HSA) contributions ($6,250 for single coverage and $12,500 for family coverage in 2013).

In a comment included in the preamble to proposed regulations on essential health benefits, HHS noted that the government does not currently plan to apply these limits to non-grandfathered self-insured group health plans and insured large group health plans. (Any remaining grandfathered group health plans would be exempt from the caps in any case.)

Proposed changes for wellness programs

Health-contingent wellness programs (formerly known as "standards-based wellness programs") are currently governed by regulations issued by the IRS, DOL, and HHS in 2006. New proposed regulations will (if finalized as proposed) make a number of changes to those rules effective for plan years starting in 2014. Most significantly:

- The potential size of the reward (or penalty) for meeting the standard will be increased from 20% to 30% of the cost of the coverage. In addition, if the reward (or penalty) is based on tobacco use, the potential size of the reward (or penalty) can be (in the aggregate) 50% of the cost of coverage.

- Individuals will have more opportunity to qualify for the reward (or avoid a penalty) without having to actually meet an applicable health standard.

Step 1: If your wellness program offers a reward (or penalty) for meeting (or failing to meet) a standard "based on the results of a measurement, test, or screening relating to a health factor (such as a biometric examination or a health risk assessment)," you must offer individuals who do not meet an applicable health standard "a different, reasonable means of qualifying for the reward." The Departments seem to contemplate performance-based alternatives such as participation in a disease management program. An alternative must be available in all cases; you cannot require verification from the individual's physician as to the need for the alternative.

Step 2: If the individual believes the proffered alternative is not appropriate for him or her, he or she may request a different alternative or an exception. At this stage, you are permitted to request verification from the individual's physician that a health factor makes it unreasonably difficult for the individual to satisfy, or medically inadvisable for the individual to attempt to satisfy the alternative standard.

- Materials describing a wellness program are supposed to provide notice of the availability of the alternative means of qualifying for a reward. The proposed regulations will require a change in the wording of the notice to something similar to the following:

Your health plan is committed to helping you achieve your best health status. Rewards for participating in a wellness program are available to all employees. If you think you might be unable to meet a standard for a reward under this wellness program, you might qualify for an opportunity to earn the same reward by different means. Contact us at [insert contact information] and we will work with you to find a wellness program with the same reward that is right for you in light of your health status.

Unfortunately, the proposed wellness regulations do nothing to address the legal uncertainties as to the application of the Americans with Disabilities Act or the Genetic Information Nondiscrimination Act. Please let us know if you want details about these issues or more information about the proposed changes for wellness programs.

Essential Health Benefits

Self-insured group health plans and insured large group health plans are not required to cover so-called essential health benefits – but they are prohibited from imposing annual or lifetime dollar limits on any essential health benefits that are covered. What are essential health benefits? Essential health benefits are the benefits covered by a base benchmark plan selected by a state (or a default base benchmark plan for states that decline to select), with certain adjustments.

HHS published proposed regulations on essential health benefits on November 20, 2012. Unfortunately, the proposed regulations do not address how self-insured plans identify essential health benefits for purposes of the prohibition on annual and lifetime dollar limits. To date, the only guidance on essential health benefits for self-insured plans is an FAQ issued February 17, 2012. That FAQ allows a self-insured plan to pick any adjusted benchmark plan. The proposed benchmark plan for each state is posted at http://cciio.cms.gov/resources/data/ehb.html, although the posted benchmark plans do not yet reflect the required adjustments. While we are still waiting for clarity and finality, the proposed regulations give us one bit of information: preventive care will always be treated as an essential health benefit. So, while a grandfathered group health plan is not required to provide first-dollar coverage for preventive care, it could not have an annual or lifetime dollar limit on preventive care. The proposed regulations indicate that essential health benefits will not include non-pediatric dental, non-pediatric eye exams, cosmetic orthodontia, and long-term custodial nursing home care benefits.

Domestic Partner Health Coverage

The Supreme Court has accepted a case challenging the federal Defense of Marriage Act (known as DOMA). A Supreme Court decision could give us the definitive answer on the constitutionality of the DOMA – and potentially change the federal taxation of health coverage provided to employees' same-sex spouses. In the meantime, the IRS continues to take the position that the value of health coverage provided to an employee's same-sex spouse (or domestic partner) must be treated as taxable to the employee for federal income tax purposes. (State income taxation varies.)

Interestingly, the IRS has a more nuanced (and difficult to administer) position on health coverage provided to the child of an employee's same-sex spouse: according to an IRS FAQ, health coverage provided to the child of an employee's same-sex spouse need not be treated as subject to federal income tax if (and only if) the employee resides in a state that recognizes the employee as the stepparent of the same-sex spouse's child. Note that Ohio would not recognize an employee as the stepparent of a same-sex spouse's child so this is not an issue for employers that only have employees in Ohio.

New 3.8% FICA Tax on Investment Income of High Income Individuals, Trusts, and Estates

The regulators issued guidance on the new 3.8% FICA tax on net investment income. Importantly, the regulators indicated that the interest/earnings component of a deferred compensation plan benefit will be treated as wages and not subject to the new 3.8% tax. For high income individuals, this may create an incentive for savings inside a deferred compensation plan.

* * *

As always, please contact us if you want more details on these developments or other employee benefits matters.