The Evaluator: Fall 2022

California Landlords Seek To Slash Real Estate Tax Assessments Due To Economic Impact Of The Covid-19 Pandemic And Remote Work

California Landlords Seek To Slash Real Estate Tax Assessments Due To Economic Impact Of The Covid-19 Pandemic And Remote Work

Some of the largest commercial property owners in San Francisco are seeking significant real estate tax assessment reductions on their assets due to the lasting impact of the COVID-19 pandemic. Click here to learn more.

Colorado Governor Signs Two Significant Property Tax Bills Into Law

Colorado Governor Signs Two Significant Property Tax Bills Into Law

The Governor of Colorado recently signed Senate Bill 22-238 (SB 238) and House Bill 22-1416 (HB 1416) into law. Click here to learn more.

Indiana Board Of Tax Review Determines Mall Anchor Department Store Should Be Valued Based Upon Income Approach

Indiana Board Of Tax Review Determines Mall Anchor Department Store Should Be Valued Based Upon Income Approach

The Indiana Board of Tax Review (IBTR) found that Dillard’s was entitled to a reduction in value because it presented better valuation evidence than the county assessor. Click here to learn more.

Kansas Supreme Court Kicks Wal-Mart Case Back To Board Of Tax Appeals With Instructions To Consider Build-To-Suit Leases

Kansas Supreme Court Kicks Wal-Mart Case Back To Board Of Tax Appeals With Instructions To Consider Build-To-Suit Leases

The Kansas Supreme Court reversed an appeals court ruling that had prevented the Kansas Board of Tax Appeals (BOTA) from considering unadjusted build-to-suit lease data in determining the property tax valuations of big box retail stores. Click here to learn more.

Connecticut Court Conducts Independent Assessment To Value Mall Property

Connecticut Court Conducts Independent Assessment To Value Mall Property

After a trial on the merits including testimony from appraisers from both the property owner and city, the Court determined its own value for the Danbury mall property. Click here to learn more.

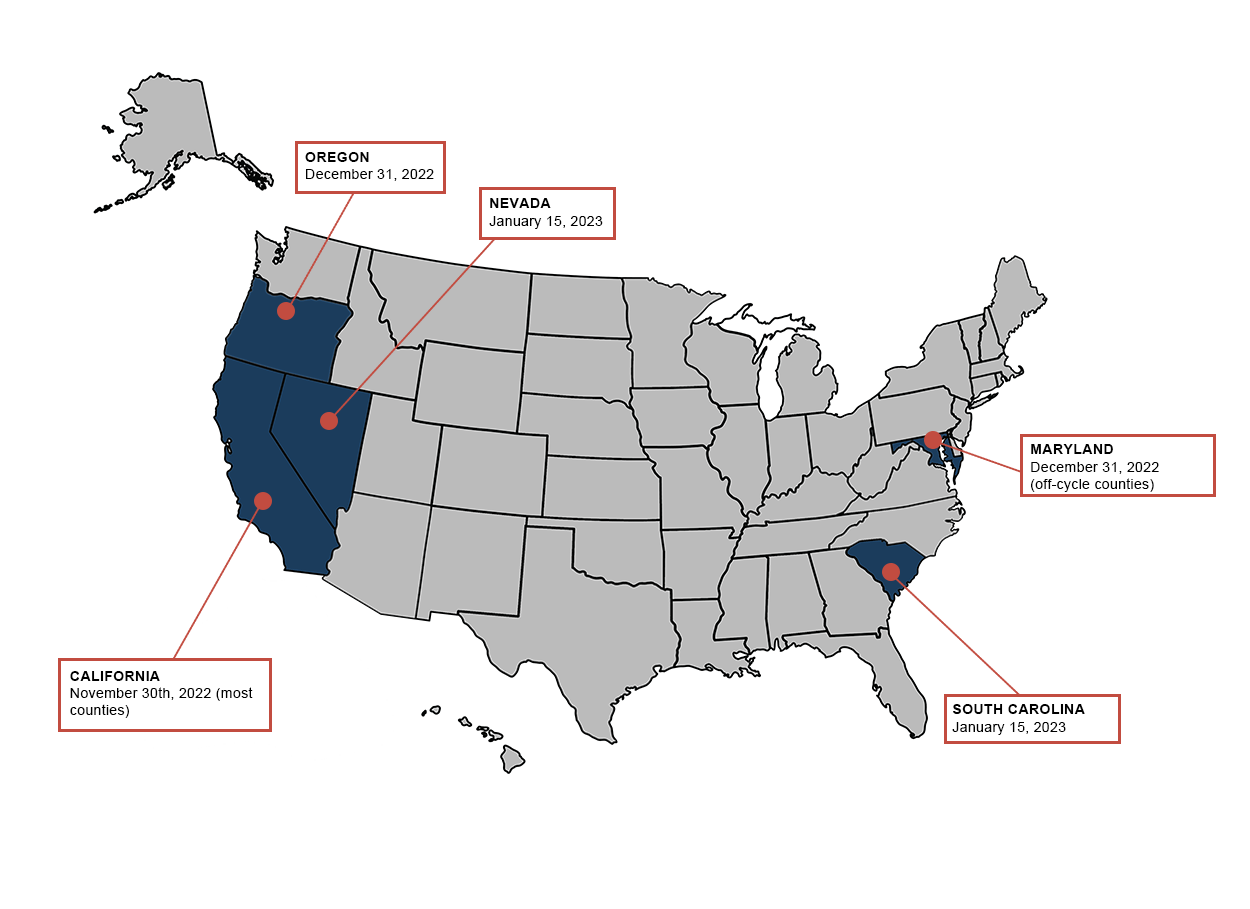

Deadlines Looming in 5 States

OTHER VALUATION HEADLINES FROM ACROSS THE COUNTRY (CLICK HERE TO READ MORE)

Idaho Supreme Court Reverses District Court’s Decision In Dispute Over Mountain Resort Valuation