The Evaluator Fall 2024

Deadlines Looming in Six States

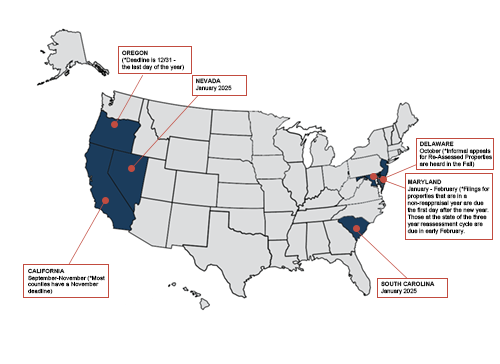

Taxpayers seeking to contest real property tax values established by assessing jurisdictions across the country often have a short window of opportunity to contest their new valuation.

_____________

HB 126 Almost Two Years Later - Implementation Status

In April 2022, Ohio Governor DeWine signed Am Sub. House Bill 126, 134th General Assembly (HB 126); a significant restriction on the activities of local boards of education (BOEs) in pursuing property taxpayers for increases in tax.

_____________

Illinois Supreme Court Affirms that Payment of Property Tax Is Not Required to Appeal to the Property Tax Appeal Board

The Illinois Supreme Court issued a determination finding a taxpayer is not required to pay its property tax bill prior to appealing to the Property Tax Appeal Board (PTAB).

_____________

The Ohio Supreme Court Permits Boards of Education to Proceed with Certain Appeals to the Ohio Board of Tax Appeals in Limited Circumstances

On September 4, 2024, the Ohio Supreme Court issued a decision permitting a board of education to challenge a board of revision decision at the Ohio Board of Tax Appeals (BTA) despite a 2022 change in law the limited the ability of governmental entities to appeal a tax valuation decision.