Whether defending against an individual consumer case or a class action, we approach all of our cases with the same philosophy: how can we achieve the best result in the most efficient way possible? We have a team of attorneys in place in every geographic area with a deep understanding of the decided case law, the judges, the trends that are emerging (that we are helping to shape) and the best approach for your particular situation. We pride ourselves on our rich and diverse consumer law experience, and our team is committed to provide counsel that is effective and straightforward.

In Consumer Cases, There's a Lot at Stake

Consumer class action cases strike at the core of your business. They can impose significant financial and reputational costs to your industry. You need experienced and passionate lawyers to help you manage these challenges. At Hinshaw, we define passion as having the commitment, conscientiousness, and resilience to succeed. We're ready to roll up our sleeves and get to work on developing creative legal solutions for you.

Experienced and Results-Orientated

Our team has successfully litigated and resolved hundreds of consumer law cases, including well over 100 TCPA cases, several hundred FDCPA and FCRA cases and numerous multidistrict national class actions, brought under these and related statutes:

- Fair Debt Collection Practices Act (FDCPA)

- Telephone Consumer Protection Act (TCPA)

- Fair Credit Reporting Act (FCRA)

- Truth in Lending Act (TILA)

- Unfair, Deceptive or Abusive Acts or Practices (UDAAP)

- Biometric Information Privacy Act

- Illinois Right of Publicity Act (IRPA)

We succeed in early case resolution at the pleadings stage but can also take a case through trial. Not many law firms can say that. We also understand the importance of laying the groundwork for successfully resolving cases on appeal. See our Representative Matters for examples of our work.

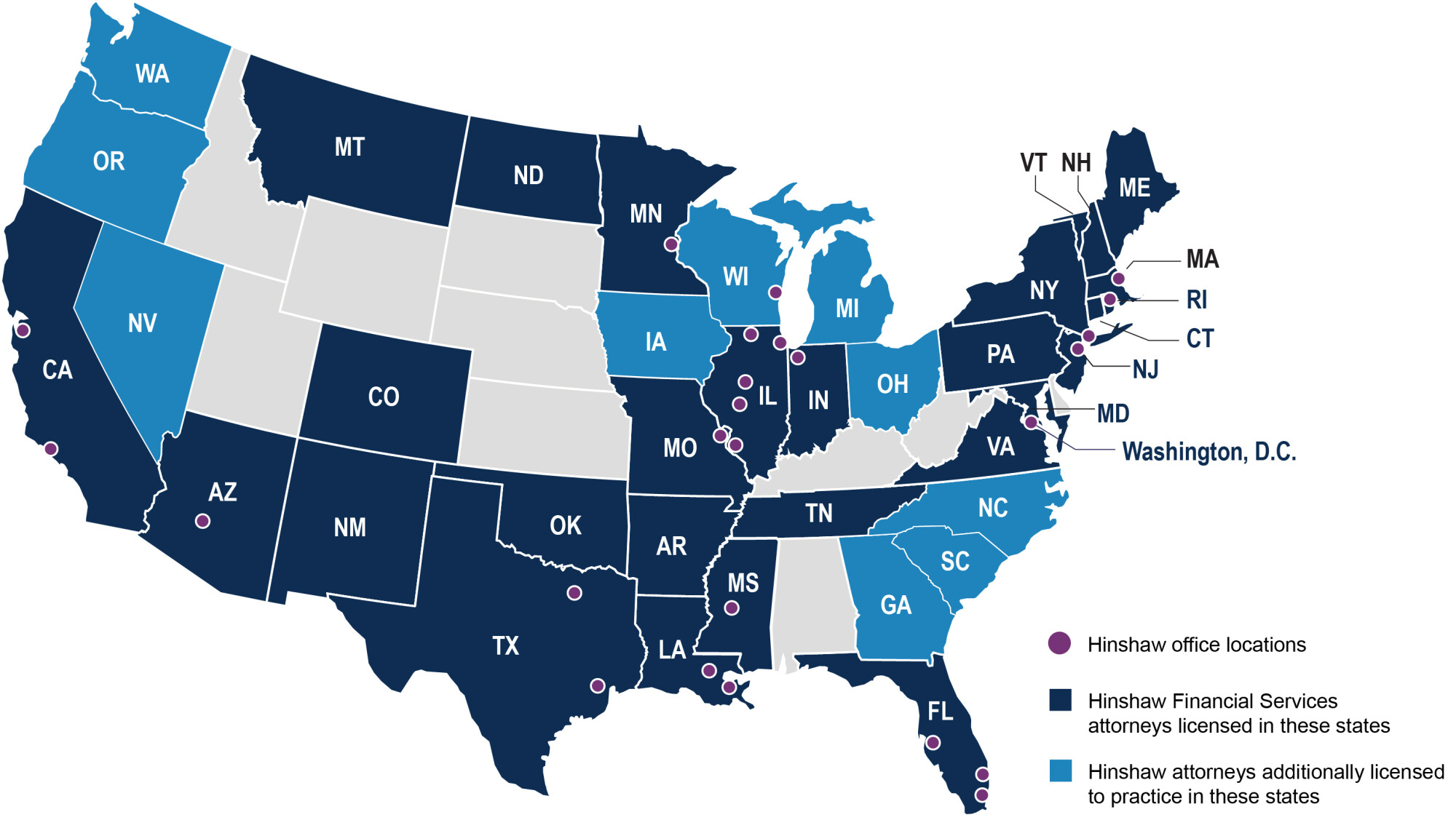

National Reach. Local Approach.

Our team offers national reach with a local approach. We are headquartered in the place that sees more TCPA class actions than any other court in the country. We have attorneys in the jurisdictions that see the most FDCPA and FCRA litigation and who know the judges and opposing counsel's tactics.

Frequently, consumer plaintiffs' lawyers seek leverage by filing multiple suits simultaneously across the country. With experience litigating in state and federal courts throughout the United States, we can counter these tactics by developing a comprehensive defense strategy that aligns with your business objectives and risk tolerance.

Our Client Service Philosophy

Our mission is to deliver highly efficient and effective client service. That means we want to get to know you, your culture, your business and your goals. That allows us to tailor our service to your needs and objectives.

When you reinvent yourself, so do we. We have been a part of organizational shifts alongside our clients, whether that's technology changes or new regulatory mandates. We don't practice law in a vacuum because we appreciate that what we call a legal challenge is your operational hurdle. But, with all the need to adapt and pivot, we know what's most important at core: Your customers. It's what drives your business, and it's what drives ours.

Thought Leadership

Following industry trends and breaking news that impacts your business—and providing analysis to you about how this impacts you is a priority for us. We blog about these topics at Consumer Crossroads, and also publish a newsletter and client alerts. Our blog is our online community. We invite you to follow the conversation by subscribing at www.hinshawcfs.com.

Related Practices

- Robert D. Bailey

- Han Sheng Beh

- Mark T. Berhow

- Samuel C. Bodurtha

- Dan L. Boho

- Dana B. Briganti

- Bryan T. Brown

- Natalie Burris

- Margaret J. Cascino

- Laurence P. Chirch

- Peter N. Cubita

- David Ian Dalby

- Gary E. Devlin

- Marissa Edwards

- Barbara Fernandez

- Jeffrey S. Fertl

- Eric J. Giglio

- Matthew R. Henderson

- Peter A. Hernandez

- Angela M. Hess

- Fred W. Hoensch

- Jacob D. Hopkins

- Zeeshan (Zee) Iqbal

- Jennifer J. Kalas

- Sue Yun Kim

- Sarah E. King

- Spencer Y. Kook

- Schuyler B. Kraus

- Mitchell S. Kurtz

- Tomislav Z. Kuzmanovic

- Edward K. Lenci

- Leah R. Lenz

- Matthew Lindsey

- Tabitha O. Mangano

- Gabrielle Mannuzza

- Stephen T. Masley

- Brian S. McGrath

- Daniel W. McGrath

- Walter McInnis

- Maura K. McKelvey

- Concepcion A. Montoya

- John Alexander Nader

- Ashley R. Newman

- Jason J. Oliveri

- Ellis M. Oster, Sr.

- Peter E. Pederson

- Justin M. Penn

- Peyton K. Phillips

- Vanessa V. Pisano

- Russell S. Ponessa

- Nicholas A. Ponzo

- Steven M. Puiszis

- Diane C. Ragosa

- Ben Z. Raindorf

- Alfredo "Fred" Ramos

- Brent M. Reitter

- David J. Richards

- Jessica A. Riley

- Daniel K. Ryan

- John P. Ryan

- Megan E. Ryan

- Dawn A. Sallerson

- David M. Schultz

- Eric J. Simonson

- Todd P. Stelter

- Gregg D. Stevens

- Peter D. Sullivan

- Aimee G. Szygenda

- Andrew P. Trevino

- Frederick J. Ufkes

- Whitney Uicker

- Matthew J. Walker

- Jennifer W. Weller

- Vanessa L. Williams

- November 1, 2021

- October 22, 2021

- August 6, 2021

- June 30, 2021

- June 21, 2021

- March 30, 2021

News

- September 26, 2025

- August 21, 2025

- June 24, 2025Peter Cubita brings a mix of in-house and private practice experience.

- February 6, 2025

- January 27, 2025

- December 9, 2024

Blog Posts

Consumer Crossroads: Where Financial Services and Litigation Intersect

- Defeated dozens of FCRA claims on behalf of furnishers for alleged improper reporting after consumers filed for bankruptcy.

- Won complete defense verdict after a four day jury trial on behalf of debt collector in a TCPA and FDCPA case where jury deliberated for only ten minutes on the TCPA claims and judge dismissed the FDCPA claims.

- Obtained summary judgment on behalf of debt collection agency, where plaintiff brought FDCPA, ICAA and TCPA claims for alleged robocalls being placed to plaintiff's cell phone. The court's opinion expressly stated that "defendant, as a third party collector for [creditor], is not subject to the TCPA prohibition on the use of autodialers to wireless numbers."

- Defeated class certification in nationwide TCPA class action. Plaintiffs sought certification of three nationwide classes, including an autodialer class, a prerecorded voice class and a skip trace class.

- Argued and won appeal before the U.S. Court of Appeals for the Second Circuit on behalf of law firm debt collector on the issue of what constitutes “debt” under the FDCPA.

- Granted summary judgment based on the U.S. Supreme Court decision Spokeo, Inc. v. Robins, by successfully arguing that FDCPA plaintiff lacked constitutional standing.

- Obtained summary judgment for debt collector by successfully arguing that one connected call out of 18 attempts over two months did not constitute harassment under the FDCPA.

- Obtained summary judgment on behalf of debt collector where plaintiff alleged an FDCPA violation for the defendant's alleged refusal to mark the plaintiff's account as disputed without further confirmation of authority from the plaintiff, when contacted by a debt management agent on the plaintiff's behalf.

- Secured dismissal of two separate cases by successfully arguing that collection of time-barred debt does not amount to misleading representation under the FDCPA.

- Won dismissal of statewide counterclaim in a putative FDCPA class action case, where the debtor sought to recover all collections received through the state over a fixed period of time.

- Secured summary judgment on behalf of a furnisher in an FCRA case that challenged the furnisher's reasonableness in relying and reporting on the information in its electronic records.

- Obtained summary judgment in favor of debt collector involving FDCPA claims that messages sent to the wrong person was not deceptive under the statute.

- Won dismissal of a FDCPA putative class action, arguing that a phrase in a settlement offer by the debt collector was not deceptive because it could be interpreted as a one-time, take-it-or-leave-it offer.

- Secured dismissal of a FDCPA putative class action, successfully arguing that delinquent highway toll charges and penalties are not considered a "consumer debt" under the FDCPA.

- Granted motion for judgment on the pleadings in a FDCPA matter, by successfully arguing that an entity collecting on a federal student loan debt as a guarantor acting in fiduciary relationship with the U.S. Department of Education, is not a debt collector under the FDCPA.

- Prevailed in a motion for judgment on the pleadings where the plaintiff alleged visibility of certain information through the glassine window of envelopes containing collection letters violated the FDCPA.

- Secured summary judgment in a lawsuit involving TCPA and FDCPA claims brought by a non-consumer plaintiff for approximately 90 alleged wrong number calls to his two cell phone numbers.

- Won partial summary judgment in a case involving TCPA and FDCPA claims brought by plaintiffs for calls made to a phone number that had been ported from a landline to a wireless number.

- 312-704-3000

- 312-704-3527