Mortgage lending and servicing can be a challenging business. Courts, legislative bodies, regulators, industry experts, consumer watchdog groups, and lawyers constantly generate new decisions, directives, and complaints that regularly change the industry's landscape. As part of an ever-changing industry, you must constantly wrestle with new and unknown obligations, risks and potential liabilities.

Passionate and Dedicated Legal Partner

You need experienced and passionate counsel to help you manage these challenges. At Hinshaw, we define passion as having the commitment, conscientiousness, and resilience to succeed. We're ready to roll up our sleeves and get to work on developing creative legal solutions on your behalf.

This is more than a fad. We have been at this since well before mortgage servicing became a buzz word. Our experience allows us to provide you with tailored legal advice necessary to meet the latest challenges and get you back to your business.

We work with clients to create favorable law. In partnership with our clients, we establish precedential legal principles. For example, matters we have assisted the industry in defining:

- When foreclosure plaintiffs have the necessary standing to pursue a legal remedy in court;

- Which portions of the power of sale must be strictly complied with prior to foreclosure;

- The validity of Assignments of Mortgage;

- When an offer to modify creates a binding contract;

- That individual borrowers do not have standing to raise non-compliance with Pooling and Servicing Agreements; and,

- A note discharged in bankruptcy can confer standing to a subsequent assignee to enforce the mortgage.

Our Client Service Philosophy

Our mission is to deliver highly effective and efficient client service. That means we want to get to know you, your culture, your business and your goals. Familiarity with your business allows us to tailor our service to your particular needs and objectives.

When you reinvent yourself, so do we. We have been a part of organizational shifts alongside our clients, whether that's servicing transfers, technology or platform changes, or regulatory mandates. We don't practice law in a vacuum because we appreciate that what we call a legal challenge is your operational hurdle. With all the need to adapt and pivot, we know what's most important at core: your customers. It's what drives your business, and it's what drives ours.

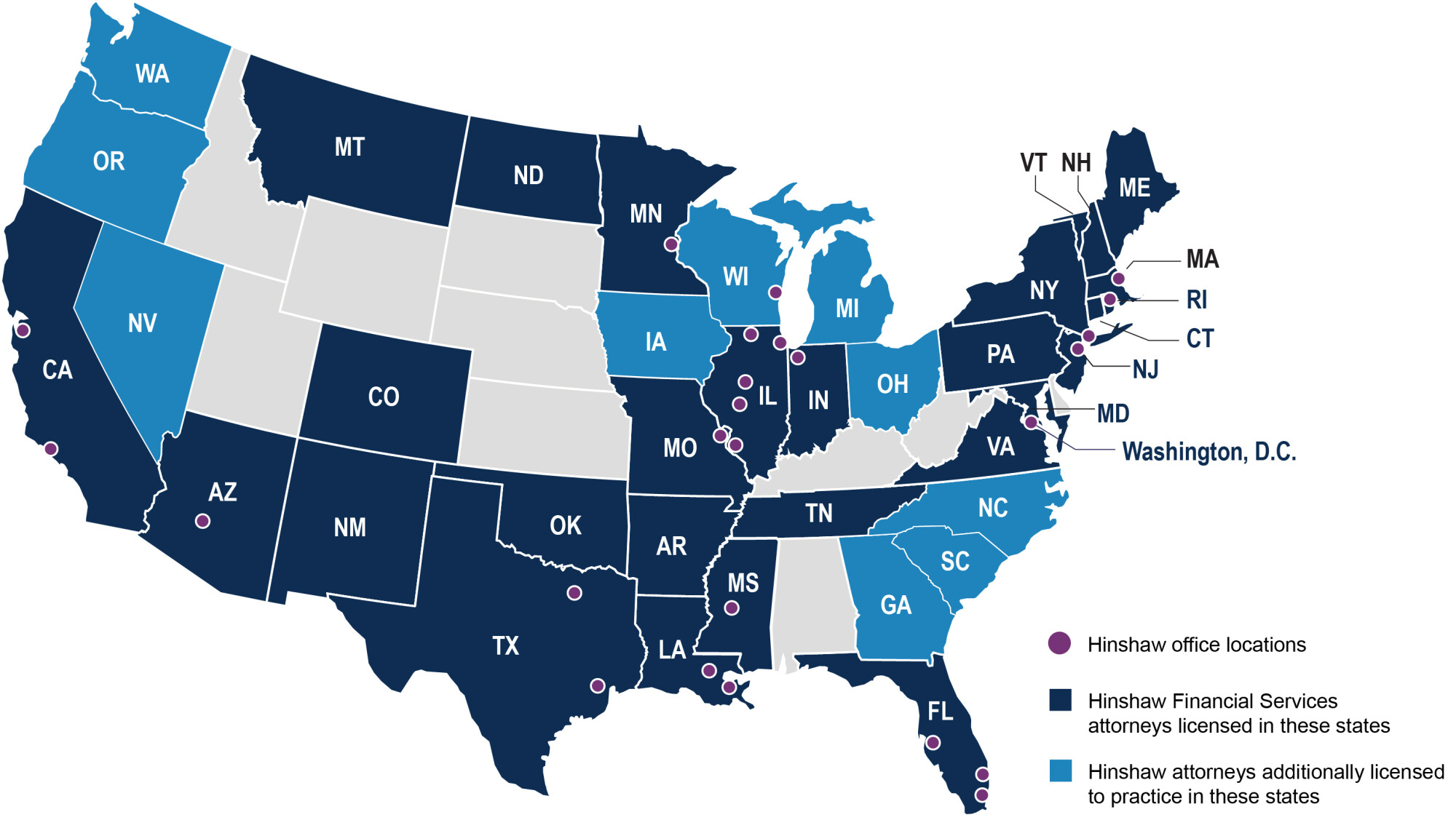

National Reach. Local Approach.

Our team has a national reach with a local approach. Our Consumer Financial Services group is a unified team of lawyers with a shared relentless passion for client-focus and attention. We offer services across the United States, utilizing best practices to meet the challenges in each jurisdiction.

Our Clients

Mortgage and lending industry participants we routinely represent include:

- financial institutions

- servicers, sub-servicers, and specialty servicers

- investors

- mortgage insurers

- warehouse lenders

Our courtroom experience includes cases in state, federal and bankruptcy courts throughout the nation. We routinely handle actions involving allegations related to wrongful foreclosure and eviction, both as class actions and individual actions. Our attorneys also manage multi-state litigation portfolios for servicing clients, including overseeing budgets, local counsel and underlying foreclosure and bankruptcy cases.

Thought Leadership

Following industry trends and breaking news that impacts your business—and providing analysis to you about them—are a priority for us. We blog about these topics at Consumer Crossroads, and also publish a newsletter and client alerts. Our blog is our online community. We invite you to follow the conversation by subscribing at www.hinshawcfs.com.

Related Practices

- Robert D. Bailey

- Han Sheng Beh

- Samuel C. Bodurtha

- Dana B. Briganti

- Bryan T. Brown

- Natalie Burris

- Elaine M. Carey

- Margaret J. Cascino

- Laurence P. Chirch

- Ralph W. Confreda, Jr.

- Michael C. Crowe

- Ali Degan

- Gary E. Devlin

- Bonnie E. Dye

- Barbara Fernandez

- Jennifer L. Fisher

- Aaron A. Fredericks

- Sarah J. Greenberg

- Peter A. Hernandez

- Alexandria A. Kaminski

- Schuyler B. Kraus

- Mitchell S. Kurtz

- Leah R. Lenz

- Melissa N. Licker

- Matthew Lindsey

- Tabitha O. Mangano

- Gabrielle Mannuzza

- Stephen T. Masley

- Brian S. McGrath

- Walter McInnis

- Maura K. McKelvey

- Michael J. McKleroy

- Concepcion A. Montoya

- Helen G. Mosothoane

- Omar Mulamekic

- Stephanie N. Mulcahy

- John Alexander Nader

- Ashley R. Newman

- Jason J. Oliveri

- Emilio Onolfi

- Ellis M. Oster, Sr.

- Ronald H. Park

- Justin M. Penn

- Vanessa V. Pisano

- Nicholas A. Ponzo

- Kathleen E. Puscheck

- Ben Z. Raindorf

- Alfredo "Fred" Ramos

- Brent M. Reitter

- Jessica A. Riley

- Fernando C. Rivera-Maissonet

- John P. Ryan

- Megan E. Ryan

- Joseph M. Sanders

- Anthony P. Scali

- David M. Schultz

- Donald W. Seeley Jr.

- Eric J. Simonson

- Mitra P. Singh

- Claire Standish

- Kyle B. Stefanczyk

- Margaret S. Stefandl

- Todd P. Stelter

- Karena J. Straub

- Mohamed F. Sweify

- C. Charles Townsend

- Whitney Uicker

- Jennifer W. Weller

- Vanessa L. Williams

- Brandon M. Wrazen

- Sam S. Zabaneh

- Mitchell E. Zipkin

- May 23, 2022

- March 30, 2021

- December 10, 2020

- November 17, 2020

- November 10, 2020

- November 9, 2020

News

- August 21, 2025

- July 29, 2025

- July 21, 2025Published as a Law360 “Expert Analysis”

- July 14, 2025

- June 16, 2025

- May 21, 2025Both Feature Columns in the May 19, 2025, Issue of the AccountsRecovery.net ARM Compliance Digest

- 212-471-6204

- 212-471-6226

- 617-213-7006

- 312-704-3000